Founder and CEO of Real Vision, Raoul Pal on behalf of Global Macro Investor, his research business (Raoul Pal – The Coming Retirement Crisis – YouTube)

Retirement is all some people ever think about, especially the 50-million-plus Americans set to retire in the next few years and the 439,000 Australians that are set to retire in 2019-20. They obsess over it. It’s what they worked for. It’s their dreams. But according to Raoul Pal, those dreams are about to be shattered.

According to Pal, we’re heading into a retirement crisis in America and around the world [including Australia] greater than anything we’ve ever seen before. This is about to occur right at the time when many people have taken on far more risk than they understand – and this is nowhere truer than in Australia.

Australian Superannuation assets totalled $2.9 trillion at the end of the June 2019 quarter; a 6.7 per cent increase in total superannuation assets over the 12 months from June 2018.

As at the end of the June 2019 quarter, 50.9 per cent of the $1.8 trillion investments [in this pool] was invested in equities; with 22.4 per cent in Australian listed equities, 24.4 per cent in international listed equities and 4.0 per cent in unlisted equities.

By contrast, only 1.07% of total super was invested in leveraged property investments [through SMSFs]. (Council of Financial Regulators)

Fixed income and cash investments accounted for 31.4 per cent of investments; 21.6 per cent in fixed income and 9.8 per cent in cash. Property and infrastructure accounted for 14.2 per cent of investments and 3.6 per cent was invested in other assets, including hedge funds and commodities.[4]

According to Pal, this heavy weighting towards equities is one of the main reasons for this massive, looming crisis. This plus 3 other distinct prongs of pressure which are all about to occur simultaneously, potentially creating what he calls “a perfect storm” that will leave many lives shattered irreparably.

What Are Pal’s 4 Distinct Pressure Points?

- All time historic high Stock Market valuations,

- A looming world recession and substantial Stock Market correction,

- A demographic shift of a magnitude never seen before as the baby boomers progressively leave the workforce,

- An over exposure to equities by the very same sector of the community [the baby boomers].

Pal Thinks It’s All Pretty Logical.

Step 1.

The world advances towards lower productivity and smaller profits caused by the recession

Step 2.

The Stock Market adjusts sharply downwards as a result (after all, high share Price-Earnings ratios are based on expectations of higher future profits).

Step 3.

Concurrently, over the same period, the largest demographic shift in history occurs.

Step 4.

Cash rates fall to zero [or lower] and retirees are forced to rely on dividends right at the time when dividends start to collapse. To fill the gap, they start selling their equities but are caught by falling prices

Step 5.

The simultaneous occurrence of all 3 pressure points and an unhappy spiral downwards kicks in collapsing the Stock Market even further.

Where Are Stock Market Valuations?

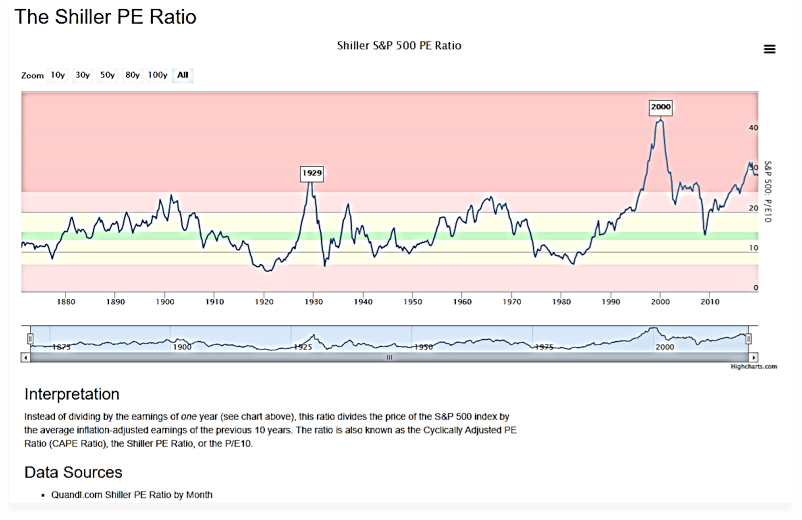

Here’s the 90-year history of the Standard & Poors Index (S&P 500)

As can be seen, this Index [one of the main US indices] is at an all-time historic valuation high. Here’s the Price Earnings Ratio [PE Ratio] for the same index since 1880:

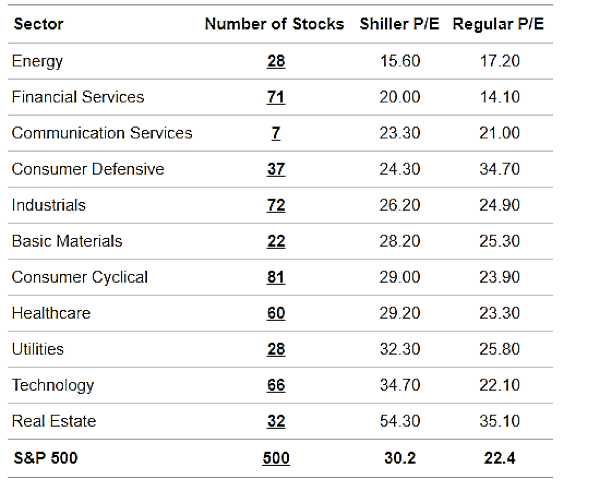

The 500 companies in the S&P Index can be divided into 11 sectors. Each sector contains a different number of companies.

So, just as Pal says, this major index is at what is pretty well and all-time high. In his analysis this has been caused by the continuing poor performance of capital assets since the GFC in 2008. The lower yields from these assets has forced individuals to continue to invest in higher risk assets than would usually be the case as people move towards retirement.

Usually, as you age you should move more and more to cash-based investments and things like government bonds. This has not occurred and the baby boomers have remained exposed to equities to a far higher degree than is prudent.

This is because no one can afford to fund retirement and everyone is taking the maximum risk.

Raoul Pal

Not only are individuals pursuing these higher returns so also are pension funds, hedge funds, corporate pension plans, venture capital funds, government funds – including defined benefit funds, and private equity funds. All of these are pursuing “risk-seeking investments” and have therefore become historically overweight in equities according to Pal. This is because no one can afford to fund retirement and everyone is taking the maximum risk. This means they have doubled up and tripled up their investment exposures to equities.

In a rising equities market this makes absolute sense. However, if things change things get very much worse. Pal says, “What is happening is that all of these investors are taking the maximum exposure in all recorded history in risk-seeking, equity like assets at a time when equity valuations are “off the charts”.

Pal thinks this is no more apparent than in the Median Price/Revenue Ratio which shows that Stock Market valuations are at the highest in 33 years:

Other ratios show the same scenario according to Pal:

- PE Ratio – most overvalued in history

- Median PE Ratio – 2nd most overvalued in history

- Market Cap to GDP ratio – most overvalued in history.

When you then consider that the pension market has the highest exposure to this sector than at any other time in history, the situation is what Pal calls “…a dangerous set-up” has all of the hallmarks of a looming calamity.

The problem is the likelihood of a global recession and Pal thinks this is a practical certainty. He says, “Recessions usually come along every 4 years but this current expansionary period is the now the second longest in all recorded history. What this tells you is that this expansion at some point has to end.”

Could It Roll On For Another Couple Of Years?

Yes, of course, it could, but the point being is “…the clock is ticking” and we are moving inexorably to towards the next recession. Normally, this is not a problem. But this time, “things are different”.

This is because the markets have not recovered since the last major global recession/correction. In Australia for example, the Stock Market Index, the All Ordinaries Index, was around 6,800 back in 2007/8 when it crashed by around 50%. Since that time, it only momentarily reached that level again just recently [for only a couple of days] before falling again and now stands at just 6,748 as at the time of this writing.

The only place this is not true is in the US. This is because the US has a “cult-like” affair with equities which is not shared by the rest of the world. According to Pal, in America, investors are 70% invested in equities and 30% into other assets such as government bonds; but in Europe, the ratio is the opposite. There, investors are 70% invested in bonds.

This will be the factor that will create what Pal refers to as “the Perfect Storm”. It’s the point where the Stock Market crashes on the back of a global recession just at the point where the maximum number of people are going into retirement. This has never happened before – anywhere – and what it means is that all of the life savings which are in equities which is basically 70% of the entire household balance sheet in America and 51% in Australia, is going to be “wiped out in one recession” and they won’t be able to buy back because they won’t have an income to buy back with.

This is what Pal describes as “The biggest problem in the world today” and “…no-one really understands this unique coming together of the Business Cycle, Risk-Taking and the Demographic Shift we are about to experience for the first time in all history”.

Roaul PaI thinks this is the biggest, single theme of our generation and believes it’s the most important thing that anybody can understand. And it’s all about the pension crisis.

And he is not alone in this…

Norman Morris, Industry Communications Director, Roy Morgan, says:

“A major problem facing the Australian government and individuals is how to fund the retirement of an ageing population. Superannuation, through its tax concessions and compulsory nature, has been the main vehicle for trying to achieve this and is having some success but total savings (including super) are still falling well short of funding those currently intending to retire.”

And the scale of the problem in Australia is massive.

In the past 2 years, using the free, online resources made available by the Australian government, the principals at Colonial Pacific, have conducted more than 350 assessments of individuals from all walks of life. In all but a small handful of the people assessed, none have sufficient assets to fund a ‘comfortable’ retirement even to the conservative level defined by ASFA, the peak policy, research and advocacy body for Australia’s superannuation, and virtually none have the means to achieve their actual retirement income goals.

But there is a solution?

We believe the ideas set out by Raoul Pal are serious enough that all Australians should be conducting a detailed review of their future retirement planning and we believe the tools provided by the government are the best suited to carry out this assessment.

These programs are free and the results are very easy to understand. Like to have us conduct a no-obligation, no-cost assessment of your future using these programs?

Phone 1300 745 420

IMPORTANT NOTE: Though our ultimate aim is to assist clients with creating a debt-free way of generating passive income in retirement Colonial Pacific are not financial advisors and do not provide financial planning or Share Market-related advice and do not deal with any investments outside of the property. All of the information provided herein is of a general nature or not specific to any individual situation. No specific decisions should be made based on any of the information provided herein and all investment decisions should only be undertaken under the advice of duly licensed professional advisers.